Feature Story Veson Nautical Shipping Market Outlook: Q4 2025 Forecast

페이지 정보

작성자 최고관리자 댓글 0건 조회 27회 작성일 25-10-12 19:50본문

Veson Nautical Shipping Market Outlook: Q4 2025 Forecast

Overview

Global shipping markets remain shaped by significant structural disruptions. The EU ban on Russian oil imports and ongoing Suez Canal diversions are extending voyage distances and tightening vessel supply.

These developments provide strong support for current freight rates. However, the market faces added complexity from a substantial shadow fleet transporting sanctioned crude and products from Russia, Iran, and Venezuela. These cargoes are primarily shipped to China and India, displacing demand for conventional tonnage.

Any successful tightening of sanctions enforcement on this grey fleet operations represents a potential upside catalyst for non-sanctioned vessel earnings and future rate expectations. Based on our forecasting data, our Shipping Market Outlook for Q4 2025 offers a quarterly summary of how this uncertainty could play out across the Tankers, Bulkers, Containers, and Gas industries.

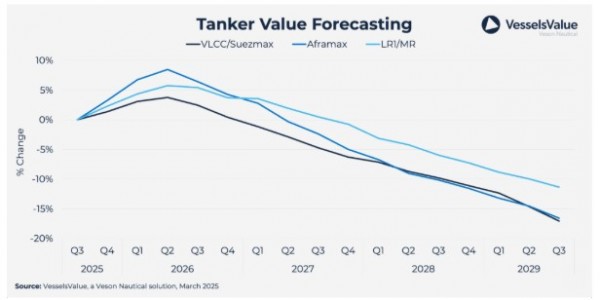

Tankers

- Geopolitical disruptions drive ton-mile demand: EU sanctions on Russian crude and Red Sea diversions have significantly extended voyage distances, with Europe’s shift from short-haul Russian supplies to longer-distance Middle East, US, and Latin American crude supporting Tanker ton mile demand.

- Peak oil demand headwinds emerging: Transportation fuel demand faces mounting pressure from engine efficiency improvements, electrification trends, fuel switching initiatives, and structural changes like remote work adoption, signalling slower demand growth ahead.

- Fleet expansion threatens market balance: Rising newbuilding deliveries and limited scrapping activity will likely create downward pressure on utilisation rates after 2025, potentially offsetting positive ton-mile developments despite the current 16% orderbook representing moderate fleet growth.

- Newbuilding activity declining sharply: Year-to-date Tanker contracting volumes remain 55% below 2024 levels, with Product Tanker orders down 70% and Crude Tanker orders falling 42%, though sustained Container vessel demand keeps shipyard utilisation elevated and newbuilding prices above historical averages.

- China remains critical demand anchor: China’s continued oil import appetite remains fundamental to Tanker market health, though growing demand from India and other Asian economies should help cushion any potential Chinese growth deceleration.

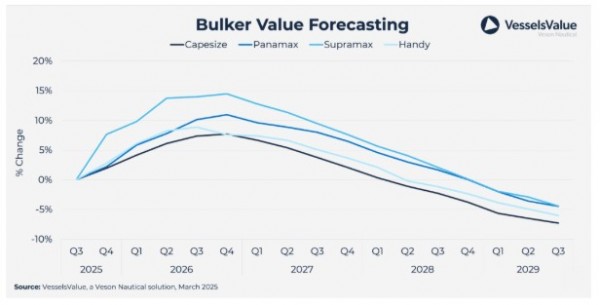

Bulkers

- Market equilibrium supports strong rates: The Bulker market is currently in healthy balance after years of low fleet growth paired with steady demand, resulting in solid freight rates throughout the year despite global economic uncertainty and subdued demand growth.

- Ton-mile demand rises despite volume declines: While iron ore and coal volumes are expected to decline, longer-haul trades, particularly the new Guinea-China iron ore route from the Simandou mine opening, combined with ongoing Red Sea diversions are boosting ton-mile demand and supporting market strength.

- China’s steel sector faces structural challenges: China’s real estate slowdown continues weighing on domestic steel demand, with both steel production and iron ore imports declining year-to-date, while steel export growth faces emerging obstacles from anti-dumping investigations and trading partner tariffs.

- Green transition creates mixed commodity flows: Decarbonisation efforts are driving strong demand for minor bulk commodities such as bauxite, supporting the China-Guinea trade, but simultaneously reducing seaborne steam coal trade as major consumers like China and India expand renewable capacity and domestic production self-sufficiency.

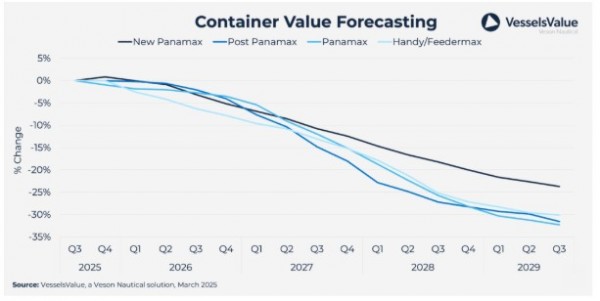

Containers

- Muted TEU-mile growth ahead despite Red Sea diversions: Container TEU-mile demand growth is expected to reach only 2.4% in 2025, followed by an average of 3% between 2026-2028, with US import tariffs dampening growth and limited upside potential from Red Sea diversions as the extra sailing distances are already factored into current market dynamics.

- Freight rates remain firm, but decline expected: Despite nearly 4.3 million TEU deliveries, freight rates have stayed firm throughout 2024 and early 2025, supported by carriers reducing average speeds by 2.3% to limit supply growth, though rates are forecast to decline steadily from 2026 onwards as fleet growth outpaces demand.

- Fleet expansion to outpace demand growth: Net fleet growth averaged 5.5% in 2023 and 9.7% in 2024, with projections of 8.7% average growth between 2025-2028 driven by high ordering activity, whilst Container TEU-mile demand growth remains more modest, creating a supply-demand imbalance.

- Strong ordering activity creates future supply surplus: High freight rates have driven robust ordering activity with approximately 3.3 mil TEU contracted in 2025, and with around 10 mil TEU entering the market over the next few years, a supply surplus is expected despite ongoing rerouting requirements from geopolitical disruptions.

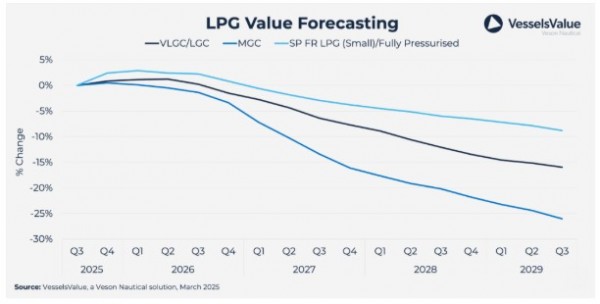

Gas

- US and Middle East export growth drives supply: US LPG production grew around 4.5% with export growth of 10.9% in 2024, whilst Middle East exports rose 6.5% despite oil production cuts, with several terminal expansions and LNG projects expected to further boost export capacity through 2028.

- Fleet expansion outpacing demand growth: VLGC/VLAC net fleet growth reached 10.9% in 2024 with average yearly growth of 7.4% forecast, whilst medium-sized vessel growth averaged 10.1% in 2024 and expects 11.4% annually through 2028, driven by high historical ordering activity despite muted 2025 contracting.

- VLGC earnings strong near-term but pressure mounting: VLGC earnings averaged 43,300 USD/day in 2024 and are expected to reach approximately 51,400 USD/day in 2025, with positive outlook for 2026 supported by increased US and Middle East volumes, though market balance will likely face pressure from 2027 onwards as new deliveries accelerate.

- China remains key demand driver despite recent softness: Asia-Pacific LPG imports grew 11% in 2024 with China’s imports from the US surging 37%, though first-half 2025 Chinese import volumes have been muted, whilst China’s planned PDH expansion should support future LPG demand growth.

- Petrochemical trades face structural challenges: Overcapacity and weak demand persist in petrochemicals with US ethylene volumes to Asia down 79% in first-half 2025 due to trade tensions, though intra-Asia trade growth and regional self-sufficiency developments are supporting CBM-mile demand as the sector awaits macroeconomic recovery.

■ Contact: Veson Nautical www.Veson.com