Feature Story Global shipping industry in mid-cycle transition

페이지 정보

작성자 최고관리자 댓글 0건 조회 20회 작성일 25-05-22 13:40본문

Global shipping industry in mid-cycle transition

- Veson Nautical white paper urges industry to study the past to prepare for the future

The current market conditions in the global shipping industry resemble the mid-cycle transition seen in previous shipping cycles - a phase where the market appears stable on the surface, but underlying pressures are quietly building. That’s the central message of a new white paper from Veson Nautical, a global leader in maritime data and freight management solutions.

Titled ‘The Anatomy of Shipping Cycles: What History Can Tell Us About Tomorrow’s Market’, the white paper argues that as fleet deliveries increase, global trade slows, and regulatory constraints tighten, the risk of tipping into overcapacity is mounting.

“Looking back at the history of previous shipping cycles, we’re likely in the mid-phase of the transition from the high point to the low,” says Matt Freeman, white paper co-author and VP of Valuation & Analytics at Veson Nautical. “To navigate this fragile equilibrium successfully will require not only operational discipline, but a deep understanding of the structural patterns that have shaped previous cycles.”

What past shipping cycles reveal

The paper explores how cyclical patterns have repeated across decades of maritime history, shaped by different macroeconomic forces, yet following a familiar arc: overconfidence, overcapacity, and correction.

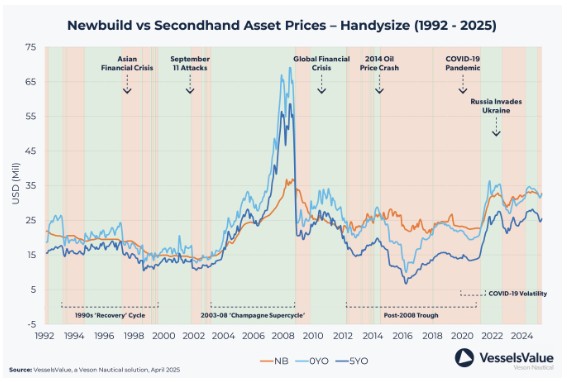

It cites the 2003–2008 “Champagne Supercycle,” driven by China’s industrial boom. At its peak, Capesize rates surged from $20,000 to nearly $200,000 per day in just five years. This spike triggered a global ordering frenzy, with the orderbook swelling to 60% of the active fleet.

“When the world was engulfed by the 2008 financial crisis, earnings collapsed almost overnight, but deliveries continued for years, compounding the downturn,” says Freeman. “If you look at examples like this, you start to see patterns that can help companies prepare for when the market inevitably turns.”

The paper also examines the COVID-19 disruption in 2020, noting that although freight rates soared, most vessel owners resisted over-ordering. The result was temporary volatility - not a full structural cycle - thanks to a more measured, disciplined response.

Reading the current signals

While no two cycles unfold in exactly the same way, the paper identifies a set of recurring markers that often precede inflection points. One of the clearest is newbuild parity - a condition where five-year-old or zero-year-old vessels[FT1] begin trading at or above the cost of newbuilds. This signal, which reflects urgency outweighing asset fundamentals, has historically appeared at market peaks, including before the 2008 crash, the 2014 oil price collapse, and the post-COVID container rate spike.

“Today, the return of newbuild parity in several market segments is a warning sign,” says Felix Tordoff, co-author and Junior Valuation Analyst at Veson. “It suggests a market where urgency is outweighing discipline, and an environment where short-term opportunity may cloud long-term judgment.”

The white paper notes that scheduled fleet deliveries are rising, particularly in the bulker segment, peaking in 2027–2028. At the same time, global trade growth is slowing, with the WTO revising its 2025 forecast down to 2.2%, well below the post-2010 average.

While new environmental regulations such as EEXI and CII may reduce effective fleet capacity, the authors argue this will not be enough to counterbalance incoming tonnage.

“Taken together, these signals suggest the industry is at an inflection point, where the next shift could come without warning,” Tordoff says. “As in previous cycles, the balance may hold for a time before tipping suddenly.”

Cycles can’t be avoided, but they can be navigated

The white paper concludes that shipping cycles are not anomalies to be feared, but recurring patterns that can be understood and strategically managed. While predicting their exact timing remains elusive, recognizing their structure and signals offers operators a powerful decision advantage.

“In today’s complex environment where sentiment is rising, supply is building, and demand is softening, you need to be able to read the signals,” Freeman concludes. “The ability to step back, assess the full cycle, and make informed decisions isn’t just smart. It’s essential.”

■ Contact: Veson Nautical www.Veson.com